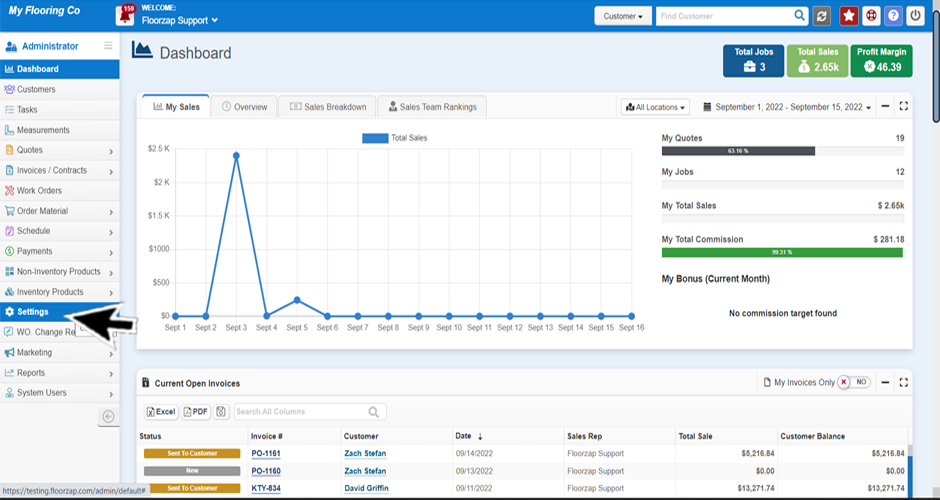

- From the dashboard navigate to the system settings by clicking on the settings tab from the left-side menu on the dashboard.

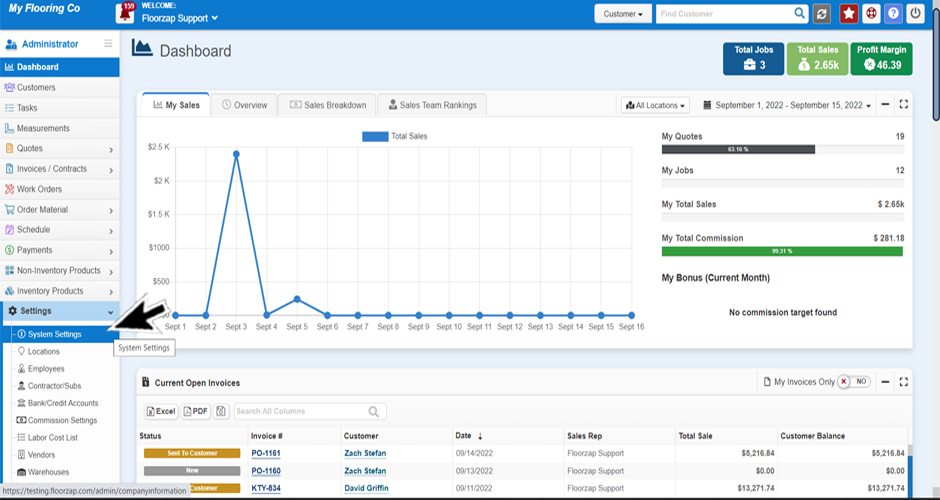

- Once you’ve clicked on settings another menu will open below, click on “system settings.” A new window will then open up.

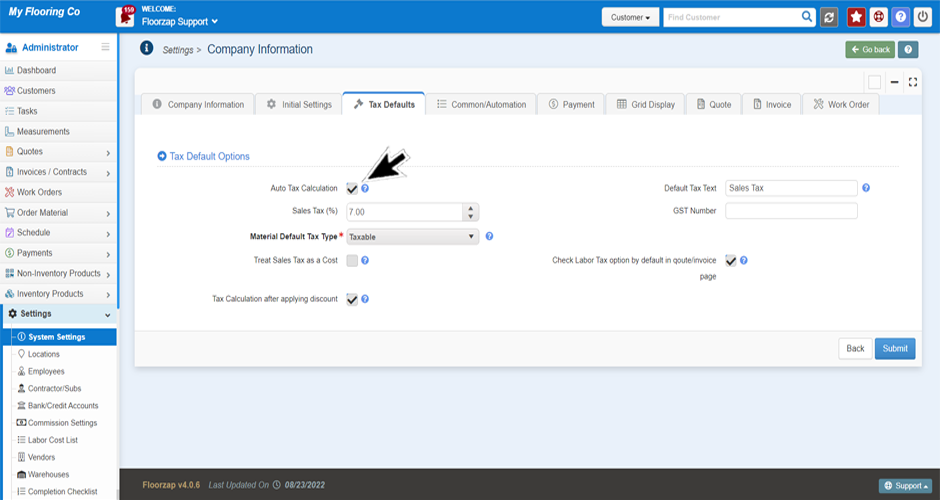

- From the top of this page click on the “tax defaults” tab.

- Uncheck the auto tax calculation button.

- Change the “default tax text” to say “GST” by typing that in.

- Check to make sure the “sales tax” rate is the correct rate for the GST.

- Click on submit to save the changes.

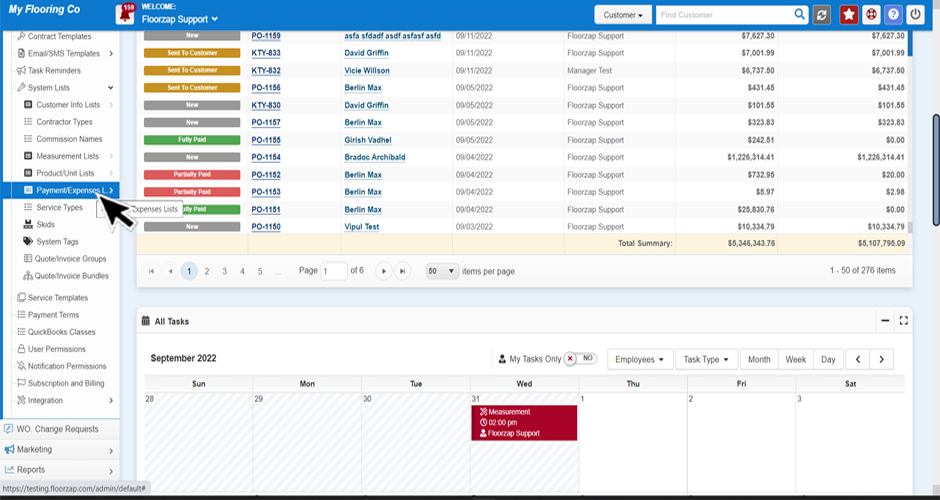

**If you also need to add PST, you can add it to the invoice expense list by following the steps below: - Click on settings from the menu on the left side of the screen.

- Scroll down until you find “system lists” and click on that tab.

- Click on “payment/expense lists.”

- Click on “invoice expense.”

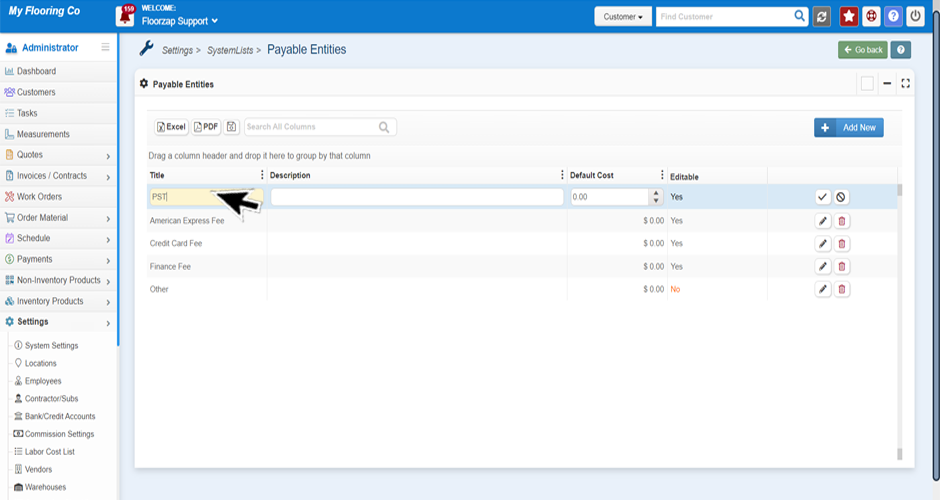

- To add PST as an expense, click the blue “add new” button.

- Fill in the PST as the expense title and any other fields you deem necessary.

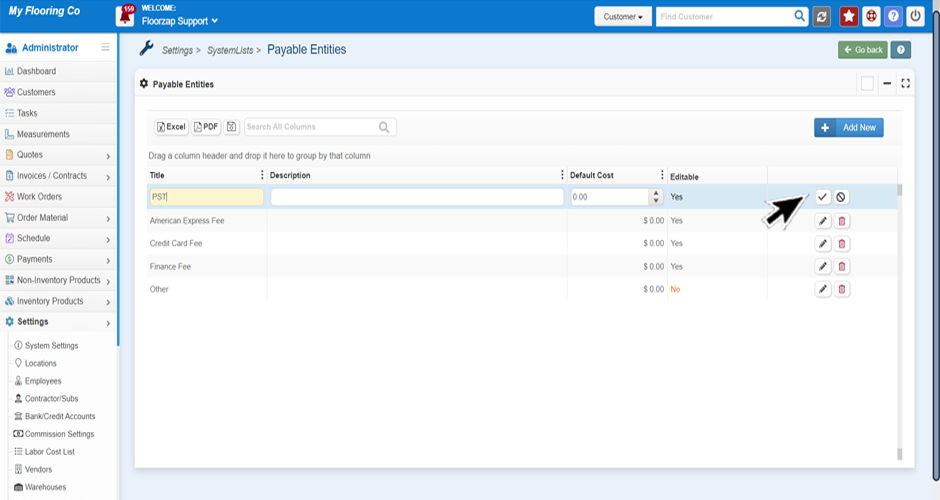

- Click the checkmark on the right side of the screen to save this expense.

**Once you have added this expense you can select it as a line item on the invoice and adjust the cost as you see fit.